How is inflation impacting your life insurance?

By Alan Friedman

Life insurance is a critical financial tool that provides peace of mind and financial protection to the survivors listed as beneficiaries on a policy upon the death of the insured.

Many individuals purchase life insurance policies to secure their family's future, to cover debts and to leave behind an inheritance. Others purchase policies to protect their business — such as key-person and buy-sell agreements — but what many people fail to realize is that the “buying power” of a life insurance policy’s death benefit may change over time.

Whether for a balloon or for our economy, too much inflation is never a good thing.

The Impact of Inflation

One of the primary factors that can erode the purchasing power of a life insurance policy over time is inflation. Inflation is the gradual increase in the cost of goods and services, which in turn reduces the “real” value of money. If a life insurance policy's death benefit was fixed at a certain amount when it was purchased years ago, that may no longer provide the same level of financial security due to the decreased value of the dollar. And most people don’t find this out until it’s too late.

Here are some examples of how inflation can affect the value of a life insurance death benefit:

Reduced Real Value: Although the nominal death benefit remains the same, the actual purchasing power of that benefit diminishes over time. What could have been a substantial sum years ago may not cover the same expenses today.

Inadequate Debt Coverage: If the policy was meant to cover specific debts such as a mortgage or loans, the policy's benefit may no longer be sufficient to settle those debts in full.

Diminished Income Replacement: If the policy was intended to replace income, it might not provide the same level of financial support due to inflation's impact on living costs.

Smaller Legacy for Beneficiaries: If the policy was purchased to leave a legacy or inheritance, inflation may reduce the real value of what can be passed on to one’s beneficiaries.

Inadequate Business Coverage:

Key-Person: If the policy was purchased to compensate for the loss of a key employee, it might not provide all the money needed.

Buy-Sell: If the policy was purchased to fund a buy-sell agreement, there will be not enough money at the time needed. This is especially common with businesses, assuming the value of the business has increased.

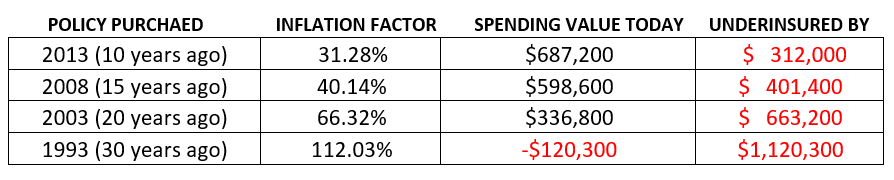

Some actual numbers to consider assuming the original face amount of the policy was $1,000,000:

The Power of the Policy Review

The best way to identify and address the issue of decreasing purchasing power in older life insurance policies is by doing an annual Policy Review. This allows you to assess a policy’s adequacy in meeting the needs, goals and objectives of the client by looking at their current financial situation in conjunction with the original reason they purchased it. A policy review is also a way to ensure that the beneficiaries listed are up-to-date and reflect the clients current wishes.

Wrapping Up

Life insurance is an important tool in financial planning, but its effectiveness can erode over time due to inflation and changing financial circumstances. It's crucial to periodically assess a life insurance policy to ensure that it continues to meet the original level of financial protection that was intended.